Have you received a collection letter from Midland Funding? Is Midland Funding appearing on your credit report? Is Midland Funding garnishing you or suing you in court?

We have countless potential clients confused when Midland Funding contacts them attempting to collect a debt. These people have never entered into an agreement with Midland Funding so they are in shock when they find out that they owe them a large amount of money.

Midland Funding is a debt buyer. A debt buyer will purchase debt from another credit card account and then begin to collect on it. Midland Funding purchases debt when the creditor no longer wishes to collect on the debt. This is usually when the account has gone 180 days without a payment or less than the minimum payment has been paid for 180 days This is also known as a charge off.

Who does Midland Funding work with?

In most cases, credit card accounts work with Midland Funding. Synchrony Bank, who partners with large retailers such as Walmart, JC Penny and Amazon, is one of the largest credit card accounts that sells their debt to Midland Funding. In addition, Comenity Bank, Chase Bank, Citibank, Credit One Bank and Webbank also sell their debt to Midland Funding.

Midland Funding Collection Activities

Even though Midland Funding likely purchased the debt for pennies on the dollar, they will not hesitate to collect on the account for the full amount owed, including interest and fees, using all of the tools at their disposal. Midland Funding will collect via debt collection letters, phone calls and even lawsuits.

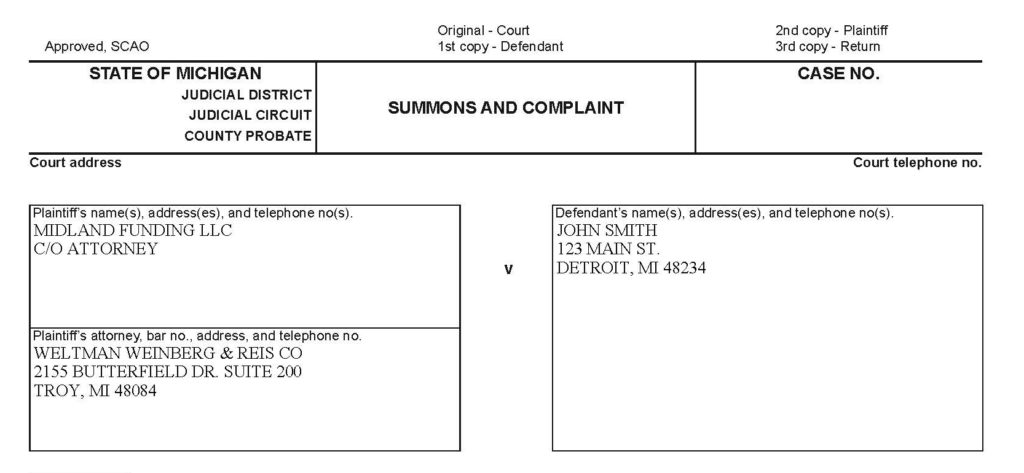

Midland Funding has relationships with law firms in the Metro Detroit area who are very skilled and aggressive in pursuing judgments and garnishments. Weltman Weinberg & Reis and Mary Jane Elliott, PC are the two largest firms in our jurisdiction who handle files for Midland Funding. These law firms will file complaints in district court to get a judgment and then immediately begin to garnish wages. These garnishments take 25% of your paycheck and will continue until the debt is paid off in full.

Midland Funding’s History of Problems

Midland Funding has been sued in 2015 and a consent order provided that Midland Funding engaged in inappropriate collection activities and violations of the Fair Credit Reporting Act such as:

-false or unsubstantiated representations about owing a debt

-misrepresenting that they have proof that the debt is owed

-filing misleading affidavits

-collecting on time-barred debt

-excessive calls at inconvenient times

Fight Back Against Midland Funding

If you are being harassed by companies, such as Midland Funding, contact our office and we can help but a stop to it. Midland Funding must comply with the provisions of the FDCPA and we will make sure they are held to it. If you are being garnished, sued or have received any correspondence from Midland Funding, we can put a stop to it immediately. We may even be able to get some money back for you. Fill out our form to see if you qualify or call our office now at (248) 237-7979 to set up a free consultation.

Clients come in to our office due to a variety of financial issues, it could be credit cards, medical bills, collection accounts, mortgage issues or lawsuits. The majority of our clients would be more than happy to pay their bills, but their current financial position prohibits them from doing so. In fact, sometimes their financial position even prevents them from paying for necessary everyday living expenses such as rent, gas, electricity and water.

Clients come in to our office due to a variety of financial issues, it could be credit cards, medical bills, collection accounts, mortgage issues or lawsuits. The majority of our clients would be more than happy to pay their bills, but their current financial position prohibits them from doing so. In fact, sometimes their financial position even prevents them from paying for necessary everyday living expenses such as rent, gas, electricity and water. The Detroit Free Press recently featured an article with attorney Drew Millitello regarding allegations of fraud by the Michigan Unemployment Insurance Agency and its relation to bankruptcy.

The Detroit Free Press recently featured an article with attorney Drew Millitello regarding allegations of fraud by the Michigan Unemployment Insurance Agency and its relation to bankruptcy. Clients call our office for a variety of debt related issues. Most of the time the client is aware of the debt and the standard ramifications of a judgment. A judgment in Michigan can result in creditors garnishing your wages, bank account, or Michigan state tax refund. It may also result in a seizure of property or a lien being placed on property. Very few clients realize that under Michigan law their license may be suspended due to an unsatisfied judgment that arose out of the ownership, maintenance, or use of a motor vehicle. Therefore, it comes as a shock when they get pulled over and the police officer explains to them that they are driving on a suspended license.

Clients call our office for a variety of debt related issues. Most of the time the client is aware of the debt and the standard ramifications of a judgment. A judgment in Michigan can result in creditors garnishing your wages, bank account, or Michigan state tax refund. It may also result in a seizure of property or a lien being placed on property. Very few clients realize that under Michigan law their license may be suspended due to an unsatisfied judgment that arose out of the ownership, maintenance, or use of a motor vehicle. Therefore, it comes as a shock when they get pulled over and the police officer explains to them that they are driving on a suspended license.