Yes. Bankruptcy without an attorney is possible. We don't recommend it, however, so this article is for information purposes only. Come in and discuss your situation with one of our lawyers even if you plan on filing bankruptcy yourself.

Why file bankruptcy without an attorney?

First things first… yes, you’re able to file Chapter 7 or Chapter 13 bankruptcy in Michigan without needing a lawyer. But why are people googling how to do it without an attorney helping them? Money! People assume they won’t be able to afford a lawyer, so they put off talking to one.

Our consultations are always free. Even if you plan on filing your own bankruptcy it’d be a good idea to come in to talk to one of our Michigan bankruptcy experts. You never know what critical piece of information you could learn that saves your house, car, or credit!

How to file bankruptcy without an attorney

First you’ll need to determine if either Chapter 7 or Chapter 13 bankruptcy is right for you. This is worth the free consultation all by itself. You want to make sure that you’re able to file and that you can protect your assets.

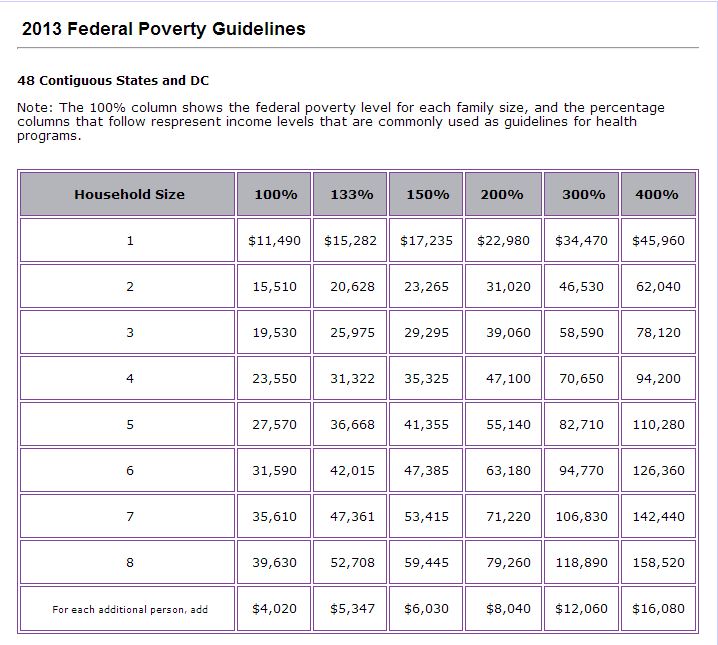

You’ll also want to make sure you know if you’ll pass the “Means Test” before you file a petition with the bankruptcy court. The proper form for the Means Test calculation (along with all other required forms) can be found on the court’s website. Sometimes waiting a month to file a bankruptcy petition can be the difference to passing the Means Test.

Where to file your case

Bankruptcy petitions are filed in Federal Court. We mostly work in the Eastern District of Michigan. If you’re in the Eastern District of Michigan you’ll either be in Detroit, Flint, or Bay City. They also hold some 341 meetings in Ann Arbor.

You’ll usually file a case based on where you lived in the 6 months prior to your bankruptcy. You can find your district by using the US Court Location by selecting “bankruptcy court” from the options.

If you moved in the 180 days before you file bankruptcy then you’ll file in the location where you lived for the majority of those 180 days. Your filing location could also depend on the location of your assets. Since different jurisdictions have different exemptions, it’s critical to know the proper place to file your bankruptcy.

Required credit counseling course

Before you can file for Chapter 7 or Chapter 13 bankruptcy without an attorney you need to complete the required credit counseling course. This law is new since 2005 and is important. While we have agencies that we recommend to our clients, the Department of Justice maintains a list of approved credit counseling agencies. You can take the class from any of the agencies on that list, but it must be done within the 180 days before you filed a case.

The course we suggest is less than $10 and can be taken online in an hour. If you put in our email address we’ll get a copy of your certificate as soon as you complete the course. This eliminates the need for you to have to print it out and bring it in before we can file your case.

Required documents

The documents you’ll need to file a case depend on your situation. The Eastern District of Michigan has a handy Chapter 7 checklist for the different forms you’ll need if you’re filing without a lawyer. Some libraries will have access to computer software that makes filling out all the required forms quicker and easier. The software is expensive; buying it probably costs more than what you’d spend on attorney fees!

After you know the proper forms to file with the court you’ll still need to know which documents you’ll need to send to the trustee for your 341 meeting. You’ll need to have your Drivers License (or ID) and Social Security Card in order to verify your identity. Other common documents you’ll need include your two most recent tax statements, six months of bank statements, six months of paystubs, vehicle titles, and recorded deeds and recorded mortgages to any property you own.

Filing fee

Speaking of fees… you’ll have to pay the Bankruptcy Court in order to file a petition unless you can get it waived. You can also apply to make the payment in installments if you’re unable to come up with the full amount when you file a case. The Chapter 7 filing fee is (as of today) $335 and Chapter 13 is $310. This amount changes from time to time so make sure you’re checking the court’s website for the current fee.

Why you should come talk to us

Bankruptcy is not a decision to be made lightly. I’ve oversimplified the process so far to give you an idea of where to start and where to go for more information. Making a mistake on your bankruptcy schedules, petition, and forms could be far worse than your current financial situation.

Don’t risk it. Come in for a free consultation so that you can learn what to do/not to do before during and after bankruptcy. We’ll explain how the whole process works and help you decide if bankruptcy is the right choice for you.

Whatever you do, please don’t avoid talking to an attorney because you think you can’t afford it. We offer free consultation as well as easy payment plans. You also may be surprised to hear that we often recover funds for our clients that have recently been garnished from their paycheck or bank account.

Good luck!