What is a Charge Off?

Past blog posts have explained the importance of your credit score. Your credit score can have an impact on your ability to get a job, insurance rates, residential leases and utilities. There is a myriad of information on your credit report, from creditor names, payment history, recent balance, account status and balance history. All of this information is used to help determine your credit score.

When we pull our client’s credit report and review it with them, the term charge off often needs to be explained in more detail. This blog post will explain what a charge off is, what a charge off means and the impact a charge off has on your credit score.

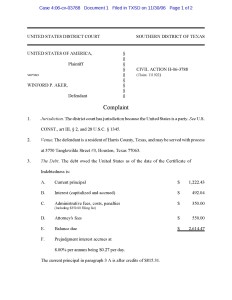

The term “charge off” can usually be found under the status section of your credit report. It will normally say something along the lines of “account charged off” or “$1,000 written off”. After 180 days of not being able to collect on an account, a creditor may list the status of an account as charged off. The creditor has given up on being repaid according to the original loan terms. The creditor has given up on being repaid under the original terms of the loan and written the loan off their receivables as a loss. Now, some of our clients think that this means the debt is no longer owed. This is NOT true.

Most creditors will sell this “charged off” or bad debt to a debt collection company for pennies on the dollar. At this point, the collection agency will attempt to collect on the unpaid portion of the debt. Now, the debt will be reported as “charged off” on one spot on your credit report and in collection on another spot – two dings to your credit report. Both of these dings will stay on your credit report for seven years from the date of your first missed payment.

If the debt is sold to a collection company then you no longer owe the original creditor and any payments you make should be to the debt collection company. If you pay the account then the status of the account should be changed to show that it was a paid charge off or paid collection.

A charge off will generally have a negative impact on your credit score; however the extent of the impact is often dependant on other factors as well. If your credit score is low due to your debt to income ratio then paying off the debt will likely increase your credit score.

If you are unable to pay the debt in full, you may be able to negotiate with the original creditor to have the charge off removed from your credit report. While the original creditor may not be able to delete the account entry and the payment history will still show up, it may be able to change the status to a more desirable status such as “paid in full”, “paid as agreed”, “account closed” or “closed”.

As always, make sure you check your credit report for accuracy. Check out our other blogs to see how to dispute inaccurate information.

I’ll let you get caught up on the facts that were reported in the

I’ll let you get caught up on the facts that were reported in the