tl;dr| Come in for a free consult and we’ll give you an exact bankruptcy cost.

Understandably, we get calls all the time wanting to know how much it’ll cost them to file for bankruptcy. Because the final cost depends on many complicated factors, the question can be difficult to answer without getting more information about your financial situation. But I know you’re not skimming through this to learn about the intricacies of all the complicated factors. Right now you want a ballpark estimate. So I’m willing to ballpark it if you promise to stick around and read the disclaimers. Deal?

We can usually get you through bankruptcy for less than $2,000 and many times it can happen for less than $1,000.

Now that we scratched that itch just please stick with me a little longer so I can explain what those costs consists of and how you can help yourself save money. The three most unavoidable cost associated with bankruptcy are the filing fees paid to the court, required credit counseling and debtor education expenses, and attorney fees. While we only directly control our attorney fees we charge (and we try to keep them as low as possible while still delivering the best value possible), we can help you save money with the other two costs.

Fees Charged By the Court to File Bankruptcy

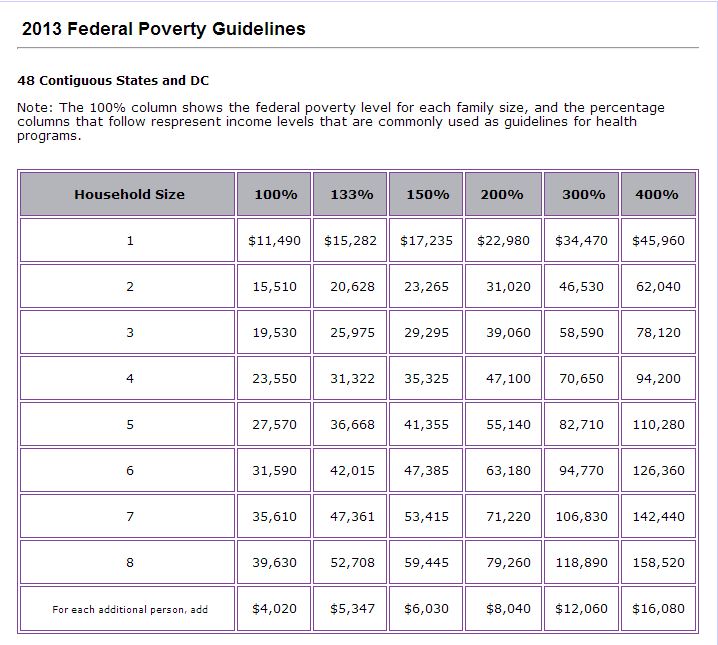

Currently, a chapter 7 bankruptcy petition costs $306 at the time of filing. The court will increase those fees every so often so keep an eye on their website (especially if this is an old post). What can you do if you need to file for bankruptcy before you have the money? You can either ask the court to pay the $306 in installments or apply for a fee waiver completely (we can do both of these things for you when you use us). The court will usually allow you to get the protection bankruptcy offers and make payments over the next few months. Getting the fee completely waived is more difficult because you have to be unable to make the filing fee payments and your income must be below 150% of the current poverty level. The picture below shows what 150% looks like for families of different sizes.

http://www.detroitlawyers.com/wp-content/uploads/2013/12/Detroit-Bankruptcy-Costs-and-Fees-300×269.jpg

Bankruptcy Cost of Credit Counseling and Debtor Education

Since 2005, in order to get a discharge of your debts you’ll have to complete both a credit counseling and debtor education course. I’ll save the particulars of how it works for another post but most approved courses charge between $20-$50. Just like most things, some places will rip you off and some might be free if you qualify. Please don’t spend more than $10, however, on a debtor education course before calling us. We’ll be able to refer you to a couple approved places will keep your bankruptcy cost to a minimum. (248) 237-7979

What About Your Attorney Fees?

Well if you stuck around this long it’s because you want to know how much WE charge. Well this is where it’s the hardest to give you an exact number without learning more about your case at a FREE CONSULTATION. Nolo says the current average is $1,200-$1,5000. Unless you have a complex or simple case, most of our fees are actually in the $800-$1,5000 range. We can usually give you a little better gauge over the phone of where you might fall but if you sit with an attorney for a free consultation you’ll get an exact number. We promise. The consultations are always completely free and you’re under no obligation if we find bankruptcy isn’t right for you.

We’re also available if you have any questions about filing yourself, advertised attorney fees that seem too good to be true (they are), and things you should look for in a bankruptcy attorney so you don’t run into problems in the future.

Call us today. You have nothing to lose.