What is an ESOP?

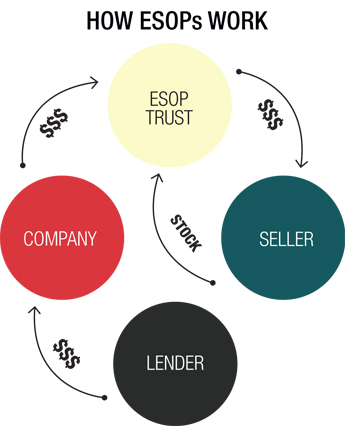

An Employee Stock Ownership Plan (ESOP) is a form of employee ownership. This type of plan gives employees of a company an ownership interest through shares allocated to them. The shares are held in an ESOP trust until the employee retires or leaves the company.

An Employee Stock Ownership Plan (ESOP) is a form of employee ownership. This type of plan gives employees of a company an ownership interest through shares allocated to them. The shares are held in an ESOP trust until the employee retires or leaves the company.

An ESOP is a form of retirement plan as defined by 4975(e)(7) of IRS codes. Similar to a 401(k), 403(b), or pension plan, this is frequently an individual’s most valuable asset. Because of their significant value, clients want to make sure they are able to keep their ESOP if they file for bankruptcy.

What Happens to my ESOP in Bankruptcy?

A two step process is required in order to determine if a client can keep a certain asset. First, is the asset a part of the bankruptcy estate. And second, if it is part of the bankruptcy estate, can it be exempt?

The filing of a bankruptcy petition creates an estate comprised of all legal or equitable interests of the debtor in property. 11 U.S.C. 541(a)(1). Even though a debtor may have an interest in property, it may not be property of the estate. 11 USC 541(c)(2) provides a restriction on the transfer of a beneficial interest of the debtor in a trust that is enforceable under applicable non-bankruptcy law. Therefore, it allows a debtor to exclude from property of the estate any interest in a plan or trust that contains a transfer restriction which is enforceable under any relevant non-bankruptcy law.

The Supreme Court has held that funds in ERISA qualified plans constitute one form of the property described in 541(c)(2) and are thus excluded from the estate. See Patterson v. Shumate, 504 U.S. 753 (1992). The court found that the anti-alienation provision required for ERISA qualification constitutes a trust enforceable under applicable non-bankruptcy law. The anti-alienation provision of ERISA accounts restricts the transfer of funds in those accounts.

Therefore, as long as the ESOP has an anti-alienation clause restricting the transfer of funds in that account, the ESOP will be excluded from the bankruptcy estate.

If you have any questions regarding an ESOP or retirement account being an asset of the bankruptcy estate, then please call our office.