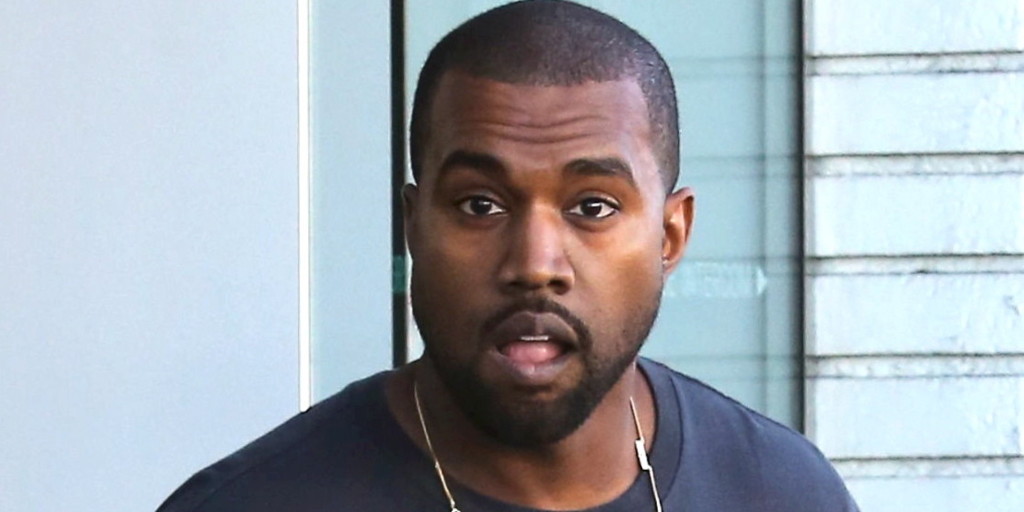

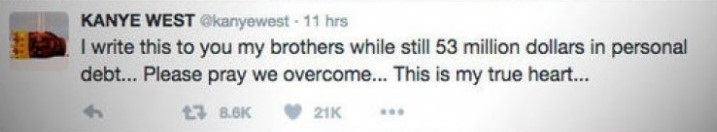

Although most of what hip-hop artist Kanye West says must be taken with a grain of salt, he recently announced that he was $53 million dollars in debt on a social media site. While this may seem outrageous, Mr. West is experiencing the same issues many consumers face on a much larger scale. In fact, as an article on Time indicated, Kanye’s $53 Million in Debt makes him a typical American. Its estimated that West earns around $22 million per year, which means his debt is approximately double his annual salary. Working with many individuals in the Metro-Detroit area, we find that this disparity is often the case.

West would be unlikely to fit in our standard Chapter 7 services offered to our clients due to his income, assets and wife’s enormous earnings. However, if we weren’t filing a bankruptcy case for West, we would at the very least offer some sound financial advice to him in exchange for a pair of Yeezy Boosts. These tips are applicable to all individuals struggling with debt.

1. Limit Large Luxury Purchases: West has recently purchased a Mercedes-Maybach which has the MSRP of well over $200,000. In addition, along with his wife, he bought a $20 Million estate in Hidden Hills. By moving into a more modest apartment and driving a Ford Fusion or Chevrolet Malibu, West would have the ability to use some of the funds to pay down a portion of his debt.

2. Consolidate Credit Card Debt at a Lower Interest Rate: While we aren’t privy to the nature of Kanye Wests’ $53 million of debt, we would advise him to explore his options to lower the interest rate on the millions he owes. If the debt is low interest around the prime rate, his annual payment would be around $3 million. However, if the debt is similar to standard credit card debt with interest rates of around 15%, that number would increase to well above $10 million. If West consolidated on a low interest or no interest card, he could reduce his obligation significantly. These cards are available to all consumers who qualify and we encourage our clients to explore them.

3. Invest Funds and Save: As stated above, West earns around $22 million per year from compensation for his music, fashion line and endorsements. West should seek the guidance of a financial advisor and invest intelligently. Even in times of financial distress, we strongly encourage our clients to continue to invest in retirement plans and other low risk investments.

4. Live Below Your Means: Despite facing $53 million in debt, West lives like an individual with reserves of cash. West continues to fly on private planes for $50,000 and recently rented out Madison Square Garden for a fashion show. When facing significant debt, we advise our clients to create a plan to live below their means. This includes spending less on food, entertainment and transportation.

5. Be Compensated for Your Work: Kanye West has just released an album and is not selling the it to the public. The album is available on a streaming service, but at this time it is impossible to purchase. As a result of this, the album has been pirated over 500,000 times in 48 hours. This approach is leaving money on the table that could be used to pay down his debt.

If you are experiencing debt issues or are considering bankruptcy, please contact our office at 248-237-7979 to speak with a licensed debt professional.