If you've been on social media in the last week you've probably heard about Paul Aker. He claims he was arrested by US Marshals because he owed student loan debt (who doesn't?).

There is STILL no Debtors’ Prison

I’ll let you get caught up on the facts that were reported in the original story here. I’m more concerned about what WASN’T reported in the original story. Although they only had a couple minutes in that video clip, I had a hard time believing the story as Mr. Aker told it. The problem? THERE IS NO PRISON FOR OWING A DEBT. In fact, Mr. Aker never even went to prison. He was taken to court for violating a judge’s order to appear.

I’ll let you get caught up on the facts that were reported in the original story here. I’m more concerned about what WASN’T reported in the original story. Although they only had a couple minutes in that video clip, I had a hard time believing the story as Mr. Aker told it. The problem? THERE IS NO PRISON FOR OWING A DEBT. In fact, Mr. Aker never even went to prison. He was taken to court for violating a judge’s order to appear.

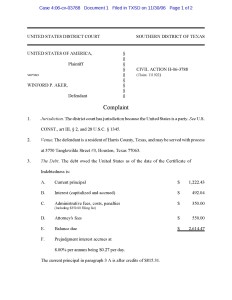

What you don’t know about this story is that Mr. Aker repeatedly told the US Marshals Service that he would not be appearing in court to answer a summons relating to a 2006 lawsuit. Court records show that Paul Aker was sued in 2006 for $2,600 in unpaid student loan debt. When Mr. Aker failed to appear for that lawsuit (after receiving notice) the judge had no choice but to rule against him for the full amount.

So even though the debt was originally federal student loan debt, refusing to obey a court order to appear is a criminal offense. It was a criminal offense for 10 years before the US Marshals arrested him and took him to court (not jail).

What Lessons Should We Learn from This?

Take ANY court summons you receive seriously. It doesn’t matter how you feel about the debt. Ignoring anything you receive from the court isn’t going to help you in the end. Hiring a lawyer will always be your best best, but even appearing on your own will at least avoid a default judgment or having a bench warrant issued because you failed to appear.

Take ANY court summons you receive seriously. It doesn’t matter how you feel about the debt. Ignoring anything you receive from the court isn’t going to help you in the end. Hiring a lawyer will always be your best best, but even appearing on your own will at least avoid a default judgment or having a bench warrant issued because you failed to appear.

In fact, many of our clients make their financial situations worse by coming to us only AFTER a creditor has starting garnishing their wages. Sometimes we’ll see the original complaint (that turned into a default judgment) and realize they could have avoided the entire debt if they had responded in a timely manner.

Ultimately, it looks like Aker was arrested due to a lack of communication with the court and not because he owed $1,500 in student loans to the government. To be clear, however, I do feel bad for Paul Aker. His defaulted student loan debt is just one small slice of a trillion dollar student loan problem in our country. Americans currently owe over $1.2 trillion in student loans. Only 1/3 of those borrowers are actively paying their student loans down while another 20% are either in default or delinquency.

What are Better Student Loan Options?

If you have federal student loans you have better options than waiting 30 years to get arrested. The National Student Loan Data System (NSLDS) has a website at www.nslds.ed.gov where you can check the status of all your federal loans. It’ll break down your different loans by semester and type and give you the current status (forbearance, deferment, default, in repayment, etc).

The hardest part of student loans is often finding all the information. When your student loans bounce around from different servicers it’s hard to keep track of who you owe. That’s why you should always start with the NSLDS website. The information should also be on your credit reports along with any private student loans you may owe. Once you’ve rounded up all the information about your different loans you’ll be able to decide what repayment options you have.

We’ve written about the different Income Based Repayment options before, but there are also statutory reasons why your debt may be forgiven or discharged as well. You may qualify for a Public Service forgiveness program, closed school, or other discharge based on your circumstances.

There are also bankruptcy options that we may be able to help you out with. Most people are aware that student loans are tough to discharge in bankruptcy, but too many people are under the false belief that it’s always impossible. Either way, talking to someone about the options specific to your student loan debt is always a better choice than “getting arrested for student loans.”