Judgments in a Nutshell

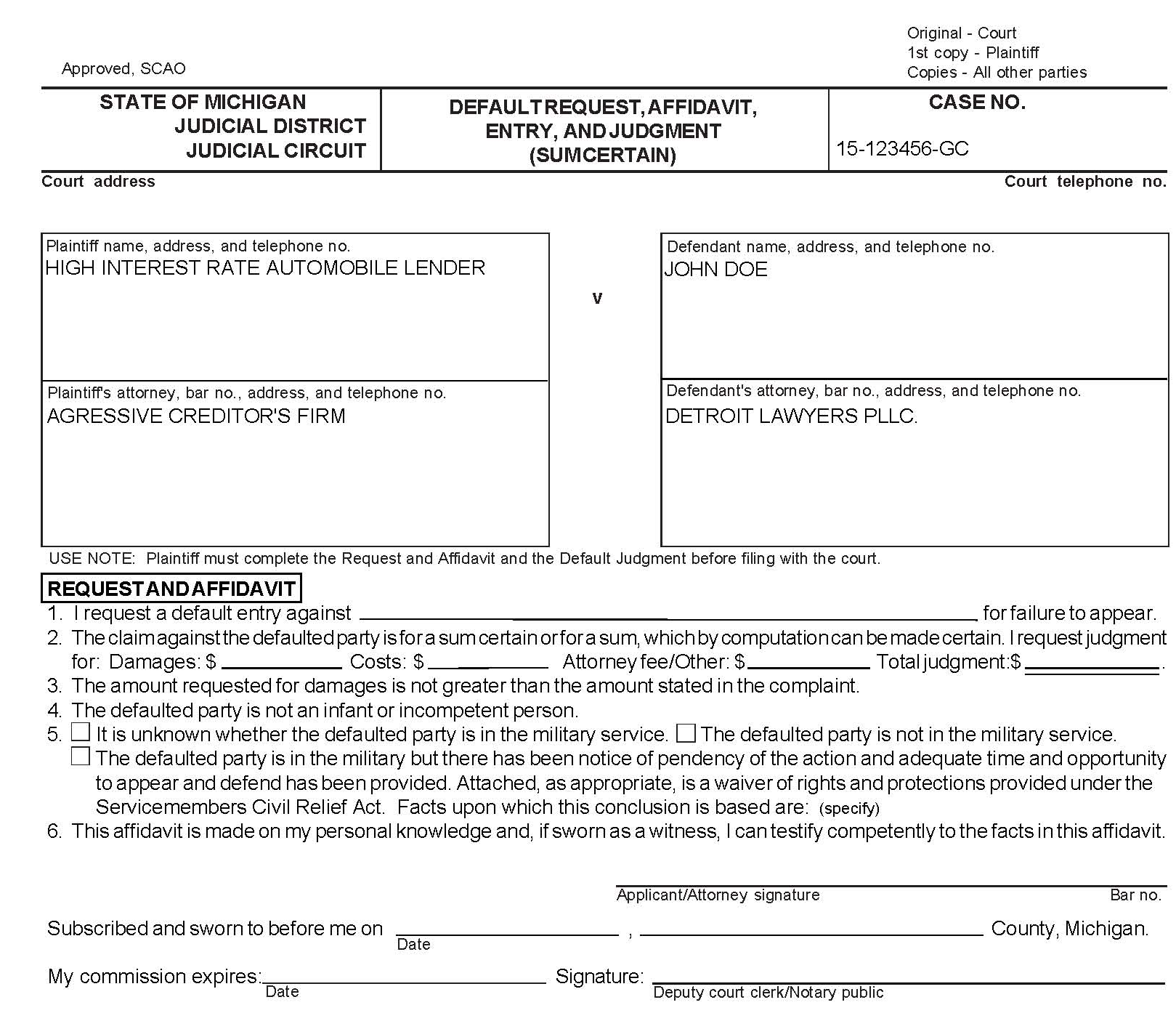

We see it all too often: A family purchases a used vehicle from a dealership down the street. Although initially unhappy about the 24.99% interest rate, they are relieved to have a method of transportation to take them to work and back, drop the children off to school and get groceries. Unfortunately the car doesn’t last. The transmission blows or there are engine problems. There is no warranty on the vehicle and the repairs are too costly to pay. The family is now forced into a decision to stop paying on the vehicle in order to save for yet another form of transportation. After a few months of missed payments, the creditor repossesses the vehicle. Not long thereafter, the family is served a complaint demanding the total unpaid amount on the automobile loan. The family is confused and scared and do not respond to the complaint. A judgment is entered on behalf of the collector. What can the family expect now? Are there any options to make it all go away?

Installment Plans

After receiving judgments, many creditors offer individuals court ordered installment plans in order to pay down the judgment. However, creditors aren’t very flexible with missed payments and a lapse in the payment plan may result in the installment plan being no longer available. This inevitably leads to drastic measures such as garnishments.

Garnishments

In order to collect on their judgment, creditors will often garnish the individual who the judgment is entered against. Garnishments are involuntary; meaning that once a garnishment is entered, there is nothing a person can do to stop the funds from being taken from them.

The first sign of a garnishment is a “Writ of Garnishment” filed in the court and served on the person who judgment was entered against. This pleading outlines the judgment amounts and indicates the Defendant has 14 days to object to the writ. If the writ is not objected to, then funds may begin to be withheld. You can object to a writ for a number of reasons: (1) your income is exempt from garnishment by law such as social security or unemployment income, (2) you have a pending bankruptcy, (3) you have an active installment plan with the court, (4) the judgment is paid in full, (5) the garnishment was not properly issued or (6) the maximum withheld exceeds allowable amount by law. Unfortunately, most individuals do not fall under any of the above categories.

Accompanying the writ, is a “Garnishee Disclosure” which must be filled out by the bank or company instructed to withhold funds. They have 14 days to fill out the form which indicates if the garnishment will be honored. The garnishment will be honored if the individual works at the place of business or has an account at the bank where the garnishment was sent. The garnishment will begin at different times depending on what type of garnishment it is. There are three forms of garnishment that creditors use: wage garnishment, bank account garnishment and tax refund garnishment.

Wage Garnishment

By far the most common form of garnishment we see is a wage garnishment. This occurs when the individual’s employer receives a writ of garnishment. As soon as the employer receives the Writ of Garnishment, withholding will begin on the first full pay period after the writ is served. The amount withheld is usually 25% of disposable earnings (gross income subtracted by taxes). After 28 days, the employer will send the funds to the creditor to pay down the judgment.

Bank account Garnishment

Another form of garnishment is a bank account garnishment. This occurs when a creditor sends a writ of garnishment to an individual’s bank account and the funds in their account are taken out and sent to the creditor. Once the writ is served on the bank, the bank will withhold all funds available. Twenty-eight days later the funds will be paid to creditors.

Tax Refund Garnishment

The final form of garnishment is a tax refund garnishment. This occurs when a creditor sends a writ to the state treasurer and the funds are taken from the tax return and sent to the creditor. The refund will be garnished for the full amount of the judgment or the total refund if the refund is less than the judgment. Twenty-eight days later the funds will be paid to creditors.

Stopping garnishments

At Detroit Lawyers, we have helped hundreds of clients stop garnishments. A Chapter 7 bankruptcy filing will stop a garnishment on the day the case is filed. If a creditor took $600 or more during the 90 days prior to filing, our clients will get that money back shortly after the case filing. Often, our clients have no out of pocket legal fees by using their garnishment recovery to pay for attorney fees.

Judgments can often be a source of major stress and concern. By scheduling a free initial consultation with a bankruptcy professional, you can take back the power and keep your hard earned money.